Scrutinizing TDFs and Considering Balanced Funds

The ease of use of target-date funds (TDFs)—for both investors and plan sponsors—has made them the default fund of choice ever since the Pension Protection Act (PPA) of 2006 allowed plan sponsors to use them as their qualified default investment alternative (QDIA).

TDFs had been around for about 13 years before the PPA, but they hadn’t gained much traction with plan sponsors. Their impressive growth post-PPA, however, has come at the expense of other types of QDIA accounts, including balanced funds, which stick to a fixed asset allocation of stocks and bonds for all participants.

“Target-date funds have become the most common QDIA choice for our plans by a wide margin,” says Greg Quick, director of retirement service for OneAmerica in Indianapolis. “Offering a series of funds geared to each participant’s age and defaulting them automatically by this age has really resonated in the market.”

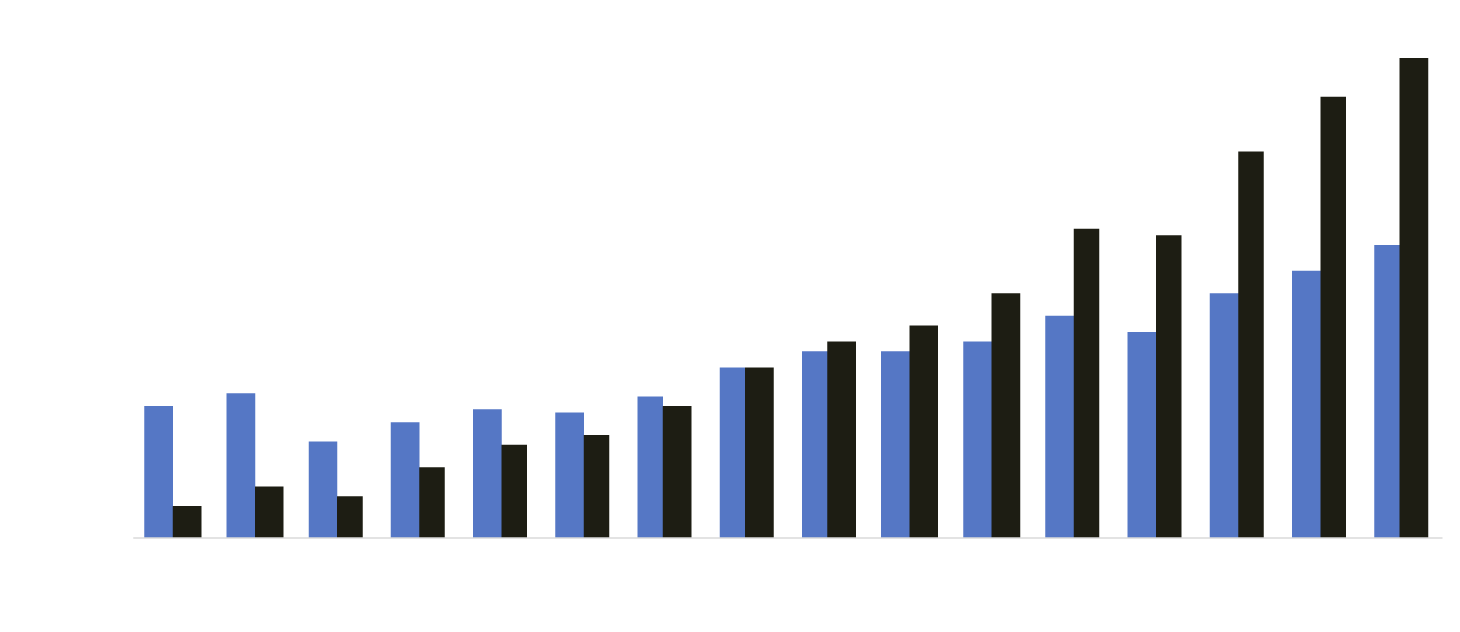

On the surface, both balanced funds and target-date funds appear happy and healthy, each managing more than a trillion dollars in assets. The robust use of both types of funds reflects higher retirement savings rates overall, sources say, largely driven by factors such as automatic enrollment and auto-escalation of contributions.

Balanced and Target-Date Fund Asset Growth

Assets in billions of U.S. dollars

Balanced___ Target Date

$1,800

$1,600

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

May 2021

$1,800

$1,600

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

May 2021

$1,800

$1,600

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

May 2021

$1,800

$1,600

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

May 2021

Note: Graph data excludes closed-end funds

Source: ISS MI Simfund

The asset growth in balanced funds has more than doubled in the 15 years since the PPA, while the total assets in TDFs have increased 13-fold. This imbalance is not surprising to many in the industry, given the perceived advantages of target-date funds. Still, with so many participants saving for a retirement date more than 10 years in the future, advisers and sponsors might want to consider whether target-date funds are providing the best solution for all participants.

‘A Big Decision’

“Choosing a QDIA is really a big decision, potentially the biggest decision a plan sponsor committee can make, so you want to make sure you’re doing all your homework and gathering all the facts before you make your decision,” says Kevin Roloff, director of research at Francis Investment Counsel in Pewaukee, Wisconsin.

It is also of paramount importance to monitor the results of this decision, he says, though this does not always happen in practice. Indeed, in a recent research paper, “The Unintended Consequences of Investing for the Long Run: Evidence from Target-Date Funds,” academics say managers of TDFs may even benefit from investors’ set-it-and-forget-it mentality, which prevents them from adequately scrutinizing poorly performing funds.

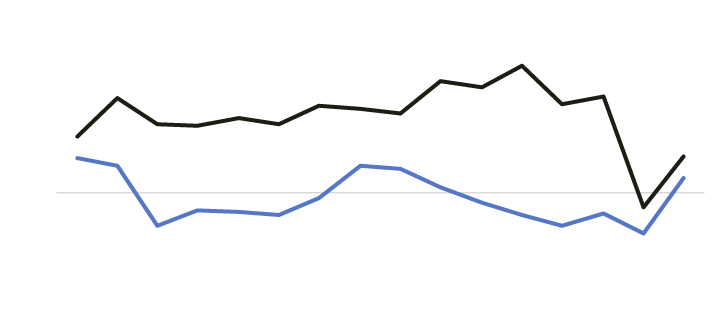

Of course, many target-date funds are living up to their performance goals, often by embracing high levels of risk for participants with longer time horizons. The same can be said of TDFs with closer retirement dates. These often take more risk than novice investors expect, leading to strong performance during bull markets but raising important questions about what might happen during the next downturn. Balanced funds, given their increased simplicity even compared with target-date funds, are less prone to such issues.

There are other drawbacks to TDFs as well. First, not all participants use target-date funds as they’re intended. A third of participants who had assets in TDFs also allocated money to other investments within their 401(k), according to Vanguard. That could potentially leave those participants with an asset allocation that’s less appropriate for them.

Still, advisers say that in most cases, the advantages of target-date funds outweigh their limitations.

“The preference for target-date funds transcends the traditional performance lens used to compare an asset-weighted TDF to a balanced fund,” says Moustapha Abounadi, head of business strategy, BNY Mellon Investor Solutions. “The perception of the benefits from an overall objective plan design perspective outweighs that potential performance drag highlighted when comparing ex-post the asset-weighted performance.”

2016 |

2017 |

2018 |

2019 |

2020 | |

| Balanced | 8.00% | 15.20% | -4.20% | 20.60% | 13.90% |

| Target-Date: In-Retirement | 5.20% | 8.90% | -2.50% | 13.60% | 10.30% |

| Target-Date 2000-10 | 6.20% | 11.50% | -3.40% | 14.70% | 10.80% |

| Target-Date 2011-15 | 6.50% | 12.40% | -3.50% | 15.60% | 11.10% |

| Target-Date 2016-20 |

6.90% | 14.40% | -4.50% | 17.60% | 12.40% |

| Target-Date 2021-25 | 7.30% | 16.10% | -5.20% | 19.40% | 13.60% |

| Target-Date 2026-30 |

7.60% | 18.30% | -6.10% | 21.20% | 14.60% |

| Target-Date 2031-35 | 8.00% | 20.00% | -6.90% | 23.10% | 15.70% |

| Target-Date 2036-40 | 8.10% | 21.20% | -7.60% | 24.40% | 16.50% |

| Target-Date 2041-45 | 8.40% | 21.60% | -7.90% | 25.10% | 17.00% |

| Target-Date 2046-50 | 8.20% | 21.70% | -8.00% | 25.20% | 17.10% |

| Target-Date 2051-55 | 8.30% | 21.70% | -7.90% | 25.20% | 17.20% |

| Target-Date 2056-60 | 8.50% | 21.60% | -7.80% | 25.20% | 17.10% |

| Target-Date 2060+ | - |

- | -8.00% | 25.10% | 16.30% |

Note: Chart data excludes closed-end funds

Source: ISS MI Simfund

Beating Inertia

A big appeal of target-date funds is that they help participants counteract inertia by rebalancing as investors age, says Ryan Gardner, managing partner and head of defined contribution (DC) at Fiducient Advisors in Windsor, Connecticut.

“Participants end up in funds because they’re defaulted into them, and after that it’s hard to make a decision,” Gardner says. “So, if that default fund is a balanced fund, you have people of all different ages and life cycles in that one fund, and you have to ask whether having one fund with one allocation is the most effective way to save for retirement.”

Roloff says there’s also another reason that many plan sponsors go the target-date route: participant preference.

“We have run a number of participant focus groups on behalf of our clients on this topic, and the overwhelming response has been in favor of target-date funds, further solidifying our preference there,” he adds.

For clients of Putnam Investments, conversations on choosing a QDIA typically focus more on which TDF to choose rather than whether to go with a target-date fund or a balanced fund, says Steve McKay, head of defined contribution investment only (DCIO) at the firm.

To assist with that process, the firm developed a target-date visualizer that helps clients compare a manager’s philosophy and glide path approach. The tool looks not just at the top-performing manager, which can be market dependent, but at each manager’s philosophy and approach to the glide path.

“Then, when you’ve narrowed it down, you look at the risk and performance metrics for target-date managers whose philosophy matches up with the pan sponsor’s,” McKay says.

There are other important factors to consider as well, when choosing between target-date funds, including the fund’s fees; whether it’s an active, passive or blended fund; and whether the glide path runs “to” or “through” retirement. That final consideration is particularly important for plan sponsors that have a large contingent of retirees who remain in plan—or for plan sponsors that want their retirees to keep their assets in the plan.

When a Balanced Fund Makes Sense

Advisers concede that there are certain circumstances in which a balanced fund might be a better QDIA selection for a plan sponsor than a target-date fund. For instance, balanced funds might make sense for employers with a less diverse employee base, for employees who largely have other sources of retirement income such as a pension, or for employees who understand investing and may prefer to take a more active role in their retirement saving.

“For employers with a more homogenous, affluent workforce that isn’t looking to their 401(k) as their main source of retirement income, the balanced fund might be the right choice,” Abounadi says. “In that case, the performance point might be more pertinent and relevant, making the balanced risk approach more appealing.”

For some plan sponsors, a balanced fund is the right choice because the plan already has an existing one that’s performing well, Roloff says.

“We have a few clients where the balanced fund has been the QDIA for a long time and the sponsor has decided not to make the switch after discussing the potential benefits of doing so,” he adds. “In those cases, the balanced fund is a good fit for the plan demographics and the 60/40 split makes sense for the employees in those instances. And the balanced funds are heavily utilized and well-liked by participants.”

Plan sponsors that have a balanced fund as their QDIA might also have a more robust approach to the support they provide to participants making investment choices, McKay says.

“They might have also have a custom target-date solution or a managed account solution that they don’t use as their default option, but they put a lot of resources into ongoing education and advice for associates and participants in the plan,” he says. “So the plan is offering true customization for those participants who want it.”

Understanding Performance

When it comes to selecting the best QDIA for a plan, whether it’s a target-date or a balanced fund, plan sponsors must look for one that best suits their needs and the participant demographics. They’ll also need to evaluate its performance.

That latter task can be a challenge when it comes to target-date funds, which are notoriously difficult to benchmark due to different glide paths and risk levels.

“No two target-date funds are the same,” McKay says. “There are some looking across the universes that can be substantially different in terms of what they do at the beginning of the glide path and at the end. So, more of the conversations now have been on philosophy and approach and how to manage risk along the glide path.”

Looking ahead, Gardner says he expects TDF balances to continue to grow.

“Participants have really gravitated to this idea of selecting one fund and having it be all inclusive, rather than spending time understanding the core options and trying to come up with an allocation that makes sense for them,” he says. “We continue to see the popularity building when it comes to target-date funds.”

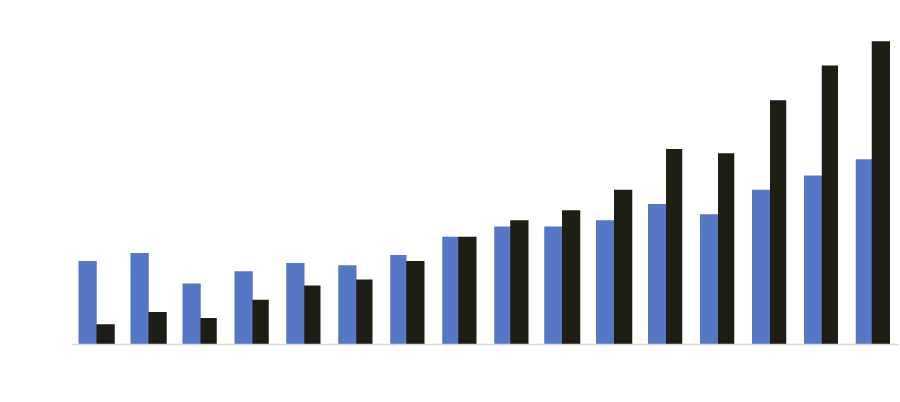

Balanced and Target-Date Fund Net Flows

Net new flows in billions of U.S. dollars

Balanced___ Target Date

$100

$80

$60

$40

$20

$0

-$20

-$40

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

YTD

May

2021

$100

$80

$60

$40

$20

$0

-$20

-$40

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

YTD

May

2021

$100

$80

$60

$40

$20

$0

-$20

-$40

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

YTD

May

2021

$100

$80

$60

$40

$20

$0

-$20

-$40

2015

2006

2007

2008

2009

2010

2011

2012

2013

2014

2016

2017

2018

2019

2020

YTD

May

2021

Note: Graph data excludes closed-end funds

Source: ISS MI Simfund

Some plan sponsors might work with a fiduciary adviser to select passive target-date funds under the impression that these funds limit their potential fiduciary liability. While that may be true compared with a choice to use an unproven actively managed option, advisers say it’s important for plan sponsors to remember that they’re never completely free from their fiduciary responsibility.

“Yes, the investment manager has fiduciary responsibility, but so does the plan sponsor,” Roloff says. “That’s why it’s important not to rely solely on the performance assessment from the provider and instead seek an evaluation of that provider by an expert adviser.”

Just as TDFs have evolved over the past decade, Gardner says he expects vendors to continue introducing new features and options. For instance, fund managers might create lower share classes for plans of a certain size or introduce more participant education on the decumulation phase of retirement saving.

You Might Also Like:

Investor Satisfaction With Online Brokerages Flatlines

LeafHouse, iJoin and ARS Launch Managed Account With Lifetime Income TDF