Never miss a story — sign up for PLANADVISER newsletters to keep up on the latest retirement plan adviser news.

HSAs Continue to Gain Steam, Top $146B in Assets

At year-end 2024, more than 59.3 million Americans were covered by a health savings account, accounted for by 39.3 million accounts, reported HSA investment solutions provider Devenir Group LLC.

According to the 2024 Devenir & HSA Council Demographic Survey, assets in HSAs reached $146.64 billion at the end of 2024, an increase of almost 16% from the year-end 2023 total of $123 billion.

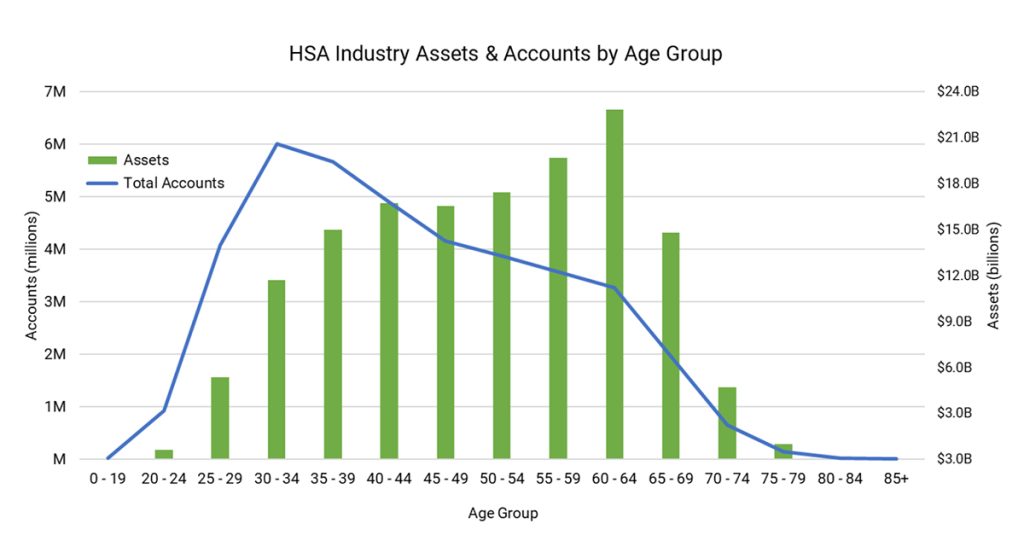

HSAs are especially popular with Millennials: By the end of 2024, individuals in their 30 held approximately 30% of all HSAs.

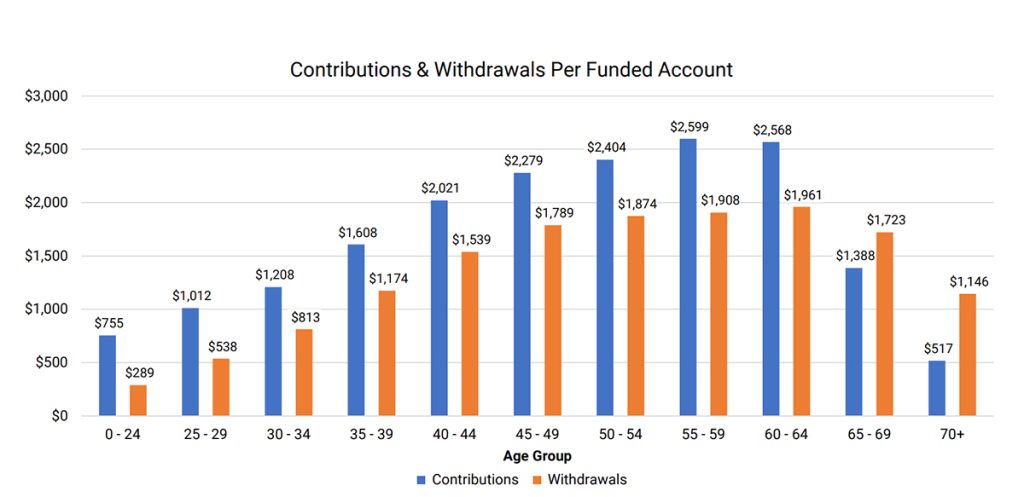

Devenir also reported that older account holders (aged at least 55) contribute heavily to their accounts and accumulated more than $63 billion in their accounts by the end of 2024, a 21% increase from the previous year. Almost one-third (29%) of HSA assets are held by accountholders aged 55 to 64 years old. Those aged 65 to 69 have the largest average account balance at $7,585, with those age 70 to 74 ranking second with an average of $7,207.

Interestingly, HSA adoption spans the socioeconomic spectrum. According to the Devenir data, 28% of account holders live in a zipcode with a median household income of less than $70,000; 64% of HSA account holders live in areas with median household incomes of less than $100,000; and 92% of account holders live in a zipcode with a median household income of less than $150,000. Devenir reported that 29.5% of account holders live in zipcodes with a median household income of $60,000 to $90,000.

Perhaps not surprisingly, states with the most HSAs and people covered by HSAs were the country’s three most populous states: Texas (3.63 million accounts, 5.64 million people covered), California (2.9 million accounts, 4.57 million people covered) and Florida (2.26 million accounts, 3.4 million people covered). The three states with the largest percentage of its privately insured population covered by an HSA were: Colorado (62%), Minnesota (55%) and Arizona (51%).

Responses from the survey were collected mostly from the 20 largest HSA providers, according to Devenir.

You Might Also Like:

Retirees’ Health Care Costs Far Outpace Social Security COLA

IRS Posts Rules for HSAs in ACA Bronze, Catastrophic Plans

HSA Limits Rise, but Frustrated Users Leave Money Behind

« Medicare Awareness Is Crucial Missing Piece in Retirement Planning