Trendspotting

Financial Wellness by Age

A generational look at financial education needs

A Financial Finesse analysis of financial wellness

assessments completed last year found that employees with higher financial

wellness scores—as measured on a 10.0 scale—also had higher contribution rates

to an employer-sponsored retirement plan.

Specifically, employees with a financial wellness score of

4.0, 5.0 or 6.0 had an average deferral rate of 6.57%, 7.38% or 8.37%,

respectively.

Using this data, Financial Finesse estimated the potential increase in retirement plan balances for a Millennial employee making $50,000 a year who improves on a 4.0 financial wellness score. For example, changes in his financial behavior that cause a 1-point improvement could potentially increase his retirement savings by over $100,000, or by more than 12%, in 40 years. Changes in financial behavior that cause a 2-point improvement could potentially increase his retirement savings by more than $260,000, or more than 27%, over that same length of time.

Financial Finesse’s research found that Baby Boomers need help in four particular areas:

- Prioritizing their retirement before helping loved ones;

- Budgeting to reduce debt and to save more, to close the retirement gap;

- Better managing their investments as they get closer to retirement; and

- Planning for long-term care costs.

According to the research report, Boomers tend to be more traditional in their communication preferences. They may be reached most effectively with a combination of interactive group-workshops, written materials and especially one-on-one personal communication with a financial planner.

According to the research, Generation X needs help with:

- Reversing the decline in money management;

- Making sure they have adequate insurance and estate planning protection; and

- Translating their growing retirement and investment awareness into saving more and investing better.

According to Liz Davidson, founder and CEO of Financial Finesse in El Segundo, California, Gen X can best relate to strategies for getting out of debt and establishing an emergency fund to avoid debt, to prepare them to save for retirement.

The research found Millennials need help in two main areas:

- Maintaining and strengthening their money management skills to avoid the same fate as Gen X. Fortunately, they will have access to technologies and financial wellness programs that the previous generations lacked.

- Giving greater priority to the importance of longer-term goals such as retirement planning and investing. Once they do so, Millennials are likely to take advantage of technologies such as retirement calculators and “robo” advisers, which can help this group in the same way they help with credit.

One thing that struck Davidson about the research is that, across generations, more people know their numbers: credit scores, how much is needed for children’s college education, or how much they will need down the road in retirement.

Jump in Advisers’ Retiree ClientsHalf of all financial advisers polled by LIMRA LOMA Secure Retirement Institute said the majority of their business consists of pre-retiree and retiree financial planning, up a whopping 40% from 2011 levels.

While targeting younger clients obviously will be important for long-term business sustainability, “retiree households will control more than half of all investable assets (approximately $25 trillion) by 2023,” the institute estimates.

“Managing these assets and their decumulation for their clients will be very important, for the foreseeable future,” says Jafor Iqbal, assistant vice president, at the institute, in Windsor, Connecticut.

The institute also found advisers have expanded their retirement income planning services significantly since 2011, especially those who offer Social Security claiming strategies. The group providing such services has more than doubled in size since 2011, jumping from 33% of advisers to 70% this year.

While some aspects of advisers’ businesses have shifted significantly since 2011, the Secure Retirement Institute also found both advisers and consumers still believe minimizing the risk of running out of money and reducing portfolio volatility are two of the three most valuable services an adviser can provide.

“While advisers consider offering a realistic view of retirement lifestyle a valuable service, consumers say creating a formal written retirement plan is more important,” Iqbal says. “Advisers surveyed in 2011 listed formal written retirement planning as the second most valuable service, which aligns with consumers’ perspectives.”

Types of Retirement Income Services That Advisers Offer

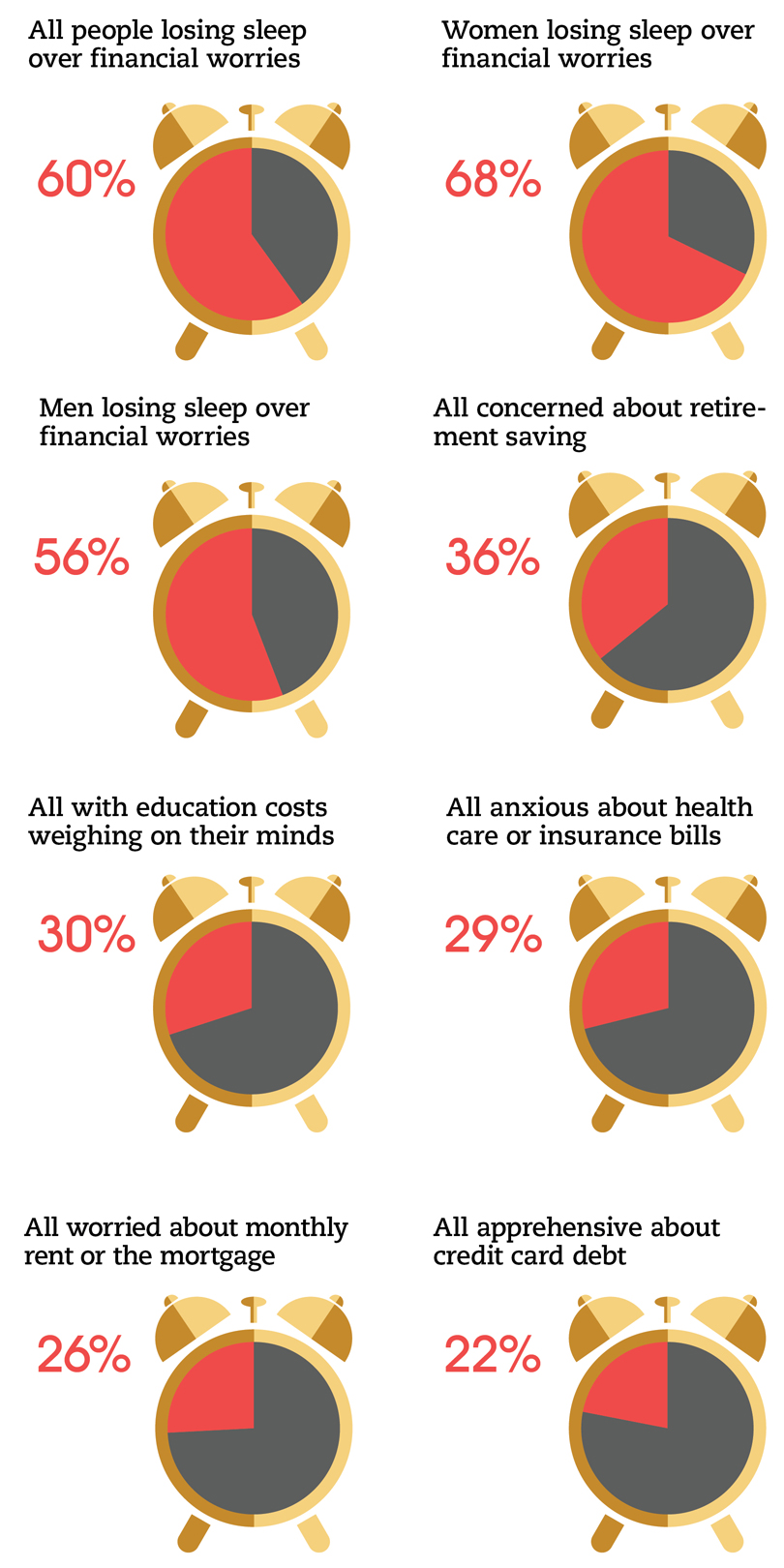

Losing Sleep Over Finances

Many Expect to Work Past Age 70

U.S. employees indicate they are willing to pay more for

retirement benefits

Twenty-three percent of United States employees surveyed by

Willis Towers Watson said they will have to work past age 70 to live

comfortably in retirement.

Nearly one-third (32%) anticipate retiring later than they

previously had planned, and another 5% think they will never be able to retire.

According to the survey, while the average U.S. employee expects to retire at

age 65, respondents admitted there is a 50% chance of working to 70.

Nearly eight in 10 workers indicated they will rely on their

employer-sponsored retirement plan(s) as the primary vehicle by which they will

save for retirement. According to the survey, more than six in 10 (62%)

respondents would be willing to pay more out of their paychecks for more

generous retirement benefits; 63% would be willing to pay more for a certain

benefit at the point of retirement.

“Employers should take this opportunity to personalize their

real-time decisionmaking support and recalibrate default enrollment to close

the gaps in employee understanding about the savings amount required and costs

in retirement,” says Shane Bartling, senior retirement consultant at Willis

Towers Watson in San Francisco.

Many employees who expect to work longer may be unable to,

due to stress or health issues. Forty percent of employees expecting to retire

past 70 have high or above average stress levels, compared with 30% of those

expecting to retire at 65. For those planning to retire after age 70, less than

half (47%) said they are in very good health, while nearly two-thirds (63%) of

those retiring at 65 said they are in very good health.

The survey also found that 40% of employees planning to work

past 70 feel they are stuck in their jobs, compared with just one-quarter of

those who expect to retire at 65 (28%) or before 65 (27%).

Twenty-four percent of employees younger than 30 believe

they will retire in their 70s or later, the percentage increasing to 28% of

those in their 30s and one-third (33%) of those in their 40s. The percentage of

U.S. men 65 or older who are working grew from 15% in 2003 to 22% last year.

Behavioral Science Jujitsu

How information is presented can improve behavior

Employee engagement with workplace defined contribution (DC)

retirement plans grew last year by every metric Bank of America Merrill Lynch

measures.

According to its Plan Wellness Scorecard for the period

ending December 31, 2015, total contributions increased 14% from 2014, while

the number of employees with balances grew 16% during the same period.

Over that year, most employees (84%) who changed their

contribution rates increased them. The number who started contributing or upped

their saving rate grew 82% from 2012 to 2015.

The survey also found that automatic enrollment plans with

higher default contribution rates were seeing greater participation as well.

Average participation for plans with a 3% default contribution rate was 78%,

compared with 83% and 88% for plans with 6% and 10% default contribution rates,

respectively.

“Employers should understand that if they increase the

default, it doesn’t have a meaningful impact on opt-out rates,” says Gary

DeMaio, head of defined contribution product for Bank of America Merrill Lynch

in Hopewell, New Jersey.

As Default Deferral Rates Rise, Participation Rates Increase, Too

- Assessment tools

- Financial literacy and wellness content addressing behavioral finance

- Instruction for how to plan—from budgeting to emergency saving to longer-term saving

- Instruction for how to execute the plan

- Data on the unique needs of the employees—what, financially, is stressing them most

Source: Schwab Retirement Plan Services

The Rear-View Mirror

More than one-third (35%) of retirees wish they had saved

more, and 29% wish they had paid more attention to preparing for retirement

when they were younger, according to a survey by Pentegra Retirement Services.

Why People Have Started Saving

Reached

a certain age

Started

a family

Were auto-enrolled

into a DC plan

Received

a pay raise

More than two-thirds have consulted an adviser

Nearly one-third of U.S. households owned individual retirement accounts (IRAs) last year, and a majority developed a strategy for managing income and assets in retirement, according to the Investment Company Institute (ICI).

More than two-thirds of traditional IRA-owning households (68%) consulted a professional financial adviser to build a strategy, says ICI’s report “The Role of IRAs in U.S. Households’ Saving for Retirement, 2015,” issued this year. Eighty-two percent took three or more steps in developing a strategy; 76% set aside emergency funds; 75% developed a retirement income plan; and 75% reviewed their asset allocation.

Among those with a strategy, besides consulting a professional financial adviser, 28% turned to friends or family, 21% accessed written materials such as a newspaper, 20% used a financial website, and 9% employed a financial software package.

ICI also found that IRAs held $7.3 trillion in assets at the end of the third quarter of last year, representing 31% of total U.S. retirement market assets—up from 18% two decades ago. Traditional IRAs were the most common type, held by 30.4 million, or 24.4% of, U.S. households in mid-2015. The next most common were Roth IRAs, held by 20.3 million, or 16.3% of, U.S. households.

IRA owners tend to hold onto their assets well into retirement, ICI found. The majority of traditional IRA withdrawals in tax year 2014 were made by retirees; most were required minimum distributions (RMDs) starting at age 70.5. These withdrawals were used for emergencies (cited by 65%), living expenses (by 62%), reinvestment (by 45%), health care (by 34%) or education (by 13%). Only 11% used their IRA money on a big-ticket item other than a home, such as a car or boat.

“IRA owners tend to steward their money to and through retirement,” says Sarah Holden, ICI’s senior director of retirement and investor research, in Washington, D.C. “Few tap into their IRAs before retirement, and most use financial advisers and other resources to develop strategies to effectively manage their savings and income in retirement.”

Despite the sizeable assets in IRAs, only 14% of U.S. households contributed to one in tax year 2014, and very few eligible households made catch-up contributions. Rather, rollover activity continued to fuel IRA growth, the institute says. More than two-thirds (69%) of rollovers to an IRA in 2015 were due to a job change, layoff or termination, while 34% were due to retirement.

When rolling over assets from their former employer’s retirement plan, 81% consulted multiple sources of information, with the majority consulting a professional adviser.

When asked for the reasons why they made the rollover, respondents most commonly said: to obtain more investment opportunities (21%), to not leave assets with their former employer (21%), and to consolidate assets (16%).

Managed-Account Holders

Adopting TDF features can make the strategy more appealing

The April issue of “The Cerulli Edge—U.S. Monthly Product Trends Edition” examines managed accounts in defined contribution (DC) plans “as a complement to target-date funds [TDFs], not a replacement for them.”

According to Cerulli, a number of hurdles exist for managed accounts if they are going to effectively replace target-date funds as the go-to choice for Employee Retirement Income Security Act (ERISA) retirement plans’ qualified default investment alternative (QDIA) in defined contribution plans. First and foremost is simply the current popularity of TDFs, especially among younger workers, the recently hired and those swept into retirement plans through automatic enrollment features.

“The target-date fund has been a success story for the retirement and asset-management industries,” Cerulli notes in the report. “They have become the investment option of choice for many DC plan investors, elegant in their simplicity and ability to offer one-stop diversification.”

However, Cerulli says, there are important arguments against use of the funds that all ERISA fiduciaries should consider: “The chief argument against target-date funds is their homogeneity, as they do not account for an investor’s risk tolerance, specific retirement plans or other assets.”

In this sense, the managed account approach “appears to be a worthy alternative to the target-date fund, as it can provide a level of customization that the target-date fund cannot by taking into account factors such as an investor’s income, age and access to a defined benefit [DB] plan.”

Agreeing with the findings from the 2015 PLANSPONSOR Defined Contribution Survey—PLANSPONSOR’s latest—Cerulli found that plan sponsors are increasingly split on where they come down in this discussion—on the side of managed accounts or target-date funds as the preferred QDIA. While the funds still dominate, Cerulli found plan sponsors have “increasingly recognized the value of the managed account, and adoption has increased at the plan level. As of year-end 2014, 22% of DC plans offered a managed account, a figure that has doubled since 2009.”

Cerulli’s report goes on to observe that managed accounts are “available to better than half of plan participants, meaning adoption of these platforms is greatest in larger plans.” Despite growing availability, participant adoption remains limited—just 7% used these accounts as of year-end 2014, Cerulli says.

DC Plans Adopt DB Traits

Many embrace lower-cost and alternative investment vehicles

Defined contribution (DC) plans continue to adopt more of the strategies of

defined benefit (DB) plans, according to a report from BNY Mellon, “The DC Plan

of the Future,” which is based on interviews with 20 plan sponsors at Fortune

500 U.S. corporations.

Specifically, defined contribution plans are adopting more lower-cost

investment vehicles, along with alternatives and income-generating products.

Thirty-six percent of the respondents said they intend to make greater use of

separate accounts, and 36% said they will decrease their use of mutual funds.

One-quarter (25%) plan to introduce white-label products that have lower costs

than mutual funds. Fifty-five percent said providing retirement income is an

important priority.

“Many of the principles and best practices of DB plans can be used to enhance

the performance of today’s DC offerings,” says Dan Smith, BNY Mellon’s head of

asset servicing for the Americas, in New York City. “DB plans typically

outperform DC plans, sometimes by as much as 2 percentage points per year.

That’s an important motivator for DC retirement plans to offer asset classes

their investors haven’t been able to access in the past. By adding alternatives

to their plan, sponsors can provide participants with downside or inflation

protection.”

Smith adds that many DC participants are investing 3% to 6% of their salaries,

in line with what defined benefit plans invest, but they would do better to

increase that to 10%.

The BNY Mellon report concludes: “Defined contribution plans have become a

critical component for retirement provision across the U.S. They have made

significant strides in terms of their evolution, but there remains work to be

done if they are to improve retirement outcomes. It is incumbent on all plan

sponsors to be able to gauge the impact of macro-industry trends on the

operation of their plans.”

How DC Plans Are 'DB-izing' Affluent Millennials Highly Engaged

separate accounts

mutual funds

white-label funds