IMHO: Overdue

We decided we weren’t sure when that would happen, we weren’t even positive that it would happen—and we really didn’t know what “it’ would be like if and when it did happen. Finally—it had been a pretty hectic week, after all—I somewhat playfully suggested that the best definition of retirement would be the absence of time-critical deadlines. Ah, now that’s something to look forward to!

Retirement has its own pressures. But the “difficulty’ that my friend and I had actually describing what we would “do’ is a real problem in retirement planning. If you don’t know what you are saving for, after all, it’s difficult to be very effective in your planning. The things we are accustomed to saving for—a car, a house, the kids’ college tuition, a vacation trip—generally are not only things we can envision, they have a very specific price tag.

Now, I know you’re thinking that retirement—more precisely, living in retirement—also has a price tag, and anyone who has an interest in knowing what that is can turn to any number of readily available calculators capable of revealing that number. Unfortunately, those disembodied numbers don’t shed much light on defining what we’ll get for our money—and they tend to be so large that the normal reaction is, “Isn’t there a cheaper model?’

I’ve seen a lot of interesting—and very creative—attempts to help overcome these obstacles, and I’ve no doubt that they have done a good job helping many participants prepare for a better retirement (whatever that may be).

To me, however, the answer to what retirement savings is for starts with a budget. And no, not what you’ll need in retirement, but what you spend money on today. The simple reason is this: A participant who doesn’t do an annual budget—even if it’s on the back of an envelope—while he or she is working doesn’t have a chance, IMHO, of beginning to understand the concept of retirement planning, much less savings.

Once you have that list of what you spend money on today, you’re well on your way to explaining what you’ll spend money on in retirement. Oh sure, some things you’ll spend more on—and others less; there are things you don’t have to buy now that you will then, and some things, like the care and feeding of your children, that you at least hope have a time limit. But I think that annual budget list answers questions about retirement in a way that no beach-umbrella-embossed retirement savings brochure ever can.

Budgets, of course, are composed of two basic elements: income and expenses. And just as surely as the latter deals with the “what am I doing this for’ motivation, I have found that filling in the gaps on the income side very effectively deals with the realities of needing to put enough money aside. Not that those answers are generally “easy,’ of course, but all of a sudden, retirement savings is transformed from looking like “extra’ money to live, to what it actually is—replacing income sources that will not continue after retirement.

Finally, having waited far too long to be willing to tell participants the truth, many now have, IMHO, gone too far the other way—insisting that we either tell participants the total amount they need to have saved at retirement, or at least some percentage representation of how close they are to attaining that total amount. Those numbers are too big to be meaningful, and the accompanying percentages generally too small to provide the encouragement participants need to stay with it.

Unfortunately, we have tended to continue to treat retirement savings as discretionary savings. Personally, I think we’d do a better job of paying that retirement bill if participants set an annual budget for retirement planning just like we have for the mortgage or the car payment. That would give them a shorter-term target that could still be part of the larger goal.

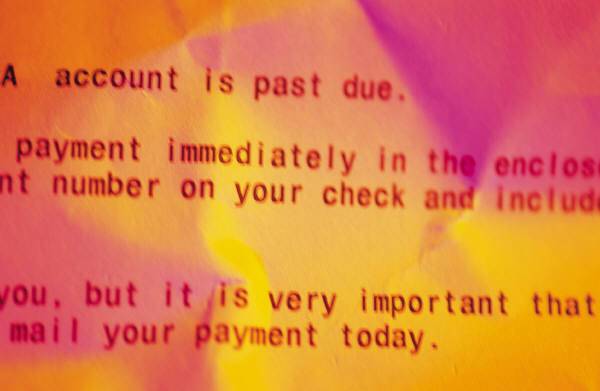

Too often, retirement savings is a function of what is left over after everything else is paid. And that means that, too often, particularly when things like health care and filling the tank cost more than we had planned, we not only don’t pay that “bill,’ we don’t even see it as overdue.